According to Taiwan's MIC (Market Intelligence & Consulting Institute), an ICT industry research institute based in Taipei, worldwide mobile phone industry's shipment volume in the third quarter of 2013 topped around 465.2 million units, up 7% sequentially. Of the total worldwide mobile phone shipments, smartphone shipment volume reached about 255.3 million units in the third quarter of 2013, representing a 13.6% sequential growth. The industry's sequential growth is mainly upheld by strong smartphone sales of Samsung and Chinese vendors, including Lenovo and Huawei, second-tier and white-box vendors.

As the entry barriers for the smartphone industry are reducing, smartphone branded vendors are facing difficulty to operate their core business. Looking ahead to 2014, three factors may be observed.

The first point to note is the impact brought by Chinese brands for the global smartphone market. In 2013, sales volume of the Chinese smartphone market totaled around 300 million units and will grow to about 400 million units. It is projected that amid the increasing adoption of smartphones in the Chinese local market, Chinese smartphone vendors have begun seeking new markets outside of China, prioritizing areas such as other Asia Pacific countries, Latin America, the Middle East and Africa. “Bolstered by high-end turkey solutions provided by MediaTek, Chinese vendors' product portfolios featuring high price-performance ratios are expected to exert increasing pressure on smartphone vendors from the abovementioned emerging markets”. “For international brands that have made long-time effort in developing their local market, those Chinese vendors are going to upset the equilibrium in those local markets”, noted Edward Lin, Senior Industry Analyst, Mobile Communications.

“For Chinese local vendors, entering the global market is just the beginning. Tapping into an unfamiliar emerging country is challenging for Chinese vendors as they have to spend time on surveying the demand of users, making channel deployments, and establishing brand images”, said Edward Lin. This is also the turning point for the industry to weed out the weak and remain the strong. The years of experience in developing international markets have put Chinese branded vendors, namely Huawei, ZTE, and Lenovo, at an advantage. The development of other Chinese vendors, for instance, Xiaomi and Coolpad remains to be seen.

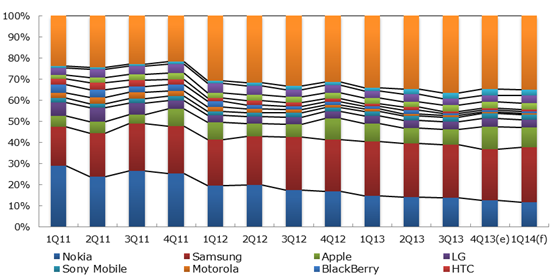

Major Mobile Phone Vendor Shipment Volume Share, 1Q 2011 - 1Q 2014

Source: Respective companies and MIC, December 2013

To see more about this report, please visit: Worldwide Major Mobile Phone Vendor Performance, 4Q 2013

For future receipt of press releases, or more information about MIC research findings, please contact MIC Public Relations.

About MIC

Market Intelligence & Consulting Institute (MIC), based in Taipei, Taiwan, was founded in 1987. MIC is Taiwan's premier IT industry research and consulting firm providing intelligence, in-depth analysis, and strategic consulting services on global IT product and technology trends, focusing on markets and industries in Asia-Pacific. MIC is part of the Institute for Information Industry. https://mic.iii.org.tw/english